Mastering Customer Acquisition Cost (CAC): Strategies for Success

21st March 2025 / in Ecommerce / by Ruturaj Kohok

Customer acquisition costs have surged 222% since 2013.

This harsh reality hits businesses hard today, as acquiring new customers costs 5 to 25 times more than keeping existing ones.

The numbers tell a compelling story – businesses spend anywhere from $7 in the travel sector to $395 in technology.

But there’s good news. A mere 5% increase in customer retention can drive profits up by 25%. Your customer acquisition strategies need smart spending rather than just spending less.

Source: Kylas

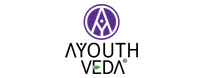

Did you know that 61% of businesses consider CAC to be one of their top 3 metrics for calculating growth?

Also, if you reduce your CAC by 10%, it can translate into a 25% increase in profits. Lastly, if you optimise your CAC, you can see a 12% improvement in your marketing ROI.

This shows just how important CAC is in your marketing efforts. So, do you want to optimise your acquisition costs and improve your bottom line?

Let’s look at proven strategies that attract and retain customers effectively.

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) shows how much your business spends to get a new customer. This customer acquisition metric includes all marketing and sales expenses.

The costs range from advertising and salaries to commissions, bonuses, and overhead costs needed to attract and convert visitors into customers.

Your CAC helps you learn about sales and marketing investments for each customer. This knowledge explains your business sustainability and growth potential.

A simple example shows this clearly: if you spend $1,200,000 in a month to get new customers and gain 1,000 customers, your CAC would be $1,200 per customer.

You can calculate CAC with the formula:

CAC = Total Marketing and Sales Expenses / Number of New Customers Acquired

These essential components make up an accurate customer acquisition cost calculation:

- Marketing program costs and advertising expenses

- Sales team salaries and commissions

- Agency fees and creative asset development

- Payment processing fees

- Marketing team salaries and overhead costs

CAC calculations work at two speeds:

- Short-term tracking (daily, weekly, monthly) – focuses on advertising tools and online marketing team metrics

- Long-term analysis (monthly, quarterly, annually) – gives a complete view of marketing, sales, and finance data

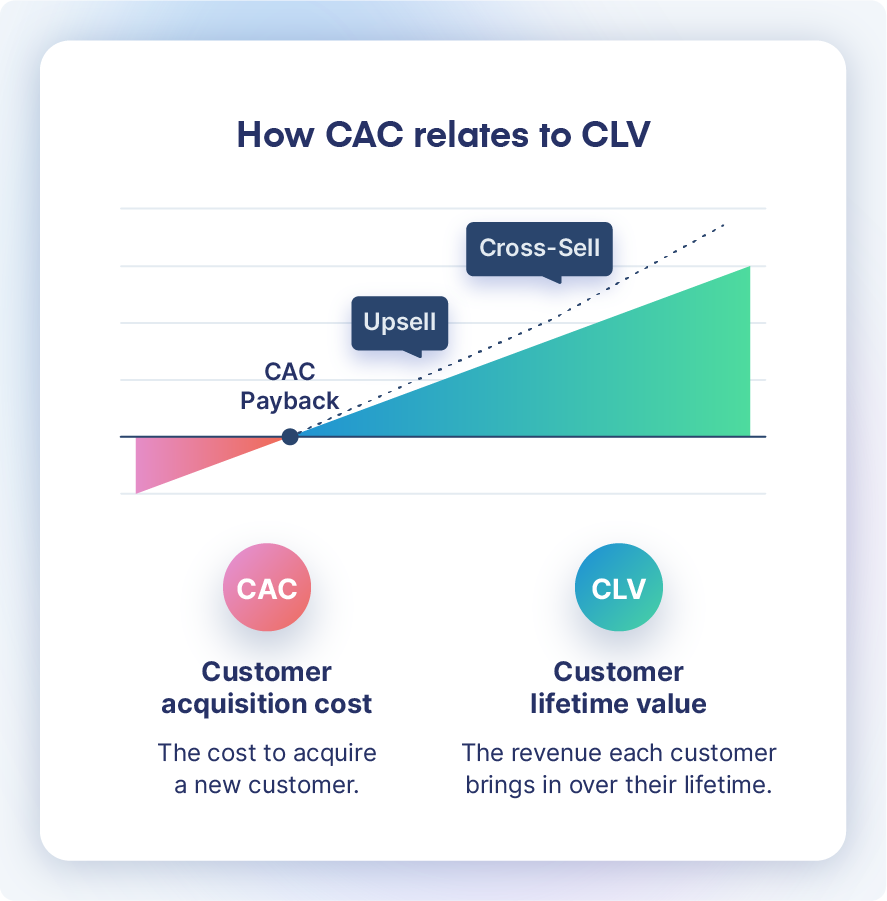

Your business’s success depends heavily on the link between CAC and profitability.

Here’s a scenario: spending $42,190.23 to get a customer who brings $25,314.14 in lifetime value creates a loss of $16,876.09 per customer.

A balanced CAC will give you sustainable growth and better operations.

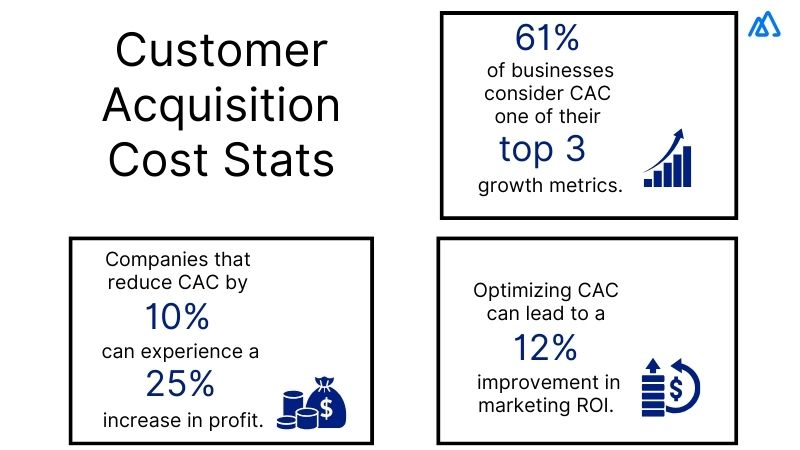

The best business results come when your customer lifetime value (CLV) is three times your acquisition cost, creating a 3:1 ratio.

Source: Clearbit

Tracking CAC with other key customer acquisition metrics helps you make smarter business decisions.

CAC serves many strategic goals:

- Reviews marketing efficiency and return on investment

- Shows where to put resources

- Helps predict revenue

- Attracts investors looking for sustainable business models

High acquisition costs usually point to problems in your marketing strategy. Poor audience targeting and weak data analysis are the main reasons.

CAC changes naturally, like a seesaw going up and down. Success comes from keeping costs below customer lifetime value while making your acquisition strategies better.

You should watch your CAC daily to keep costs in check. Looking at CAC next to Monthly Recurring Revenue shows if your company runs efficiently.

This integrated approach to tracking and improving CAC ended up boosting profitability and sustainable growth.

How is Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) related?

- Purchase Frequency and Average Order Value (AOV)

- More frequent purchases show better customer engagement

- Higher AOV helps recover acquisition costs faster

- Both these factors help improve the CLV:CAC ratio

- Customer Retention Effect

- Better retention rates mean customers stay longer

- Longer customer relationships naturally boost CLV

- Lower churn rates help preserve value over time

Source: Omniconvert

The math behind these metrics reveals key business insights. You can find the ratio by dividing lifetime value by customer acquisition cost.

To cite an instance:

- Customer contribution margin: $1,687.61

- Customer retention rate: 75%

- Total LTV: $6,750.44

- CAC: $843.80

- Final LTV:CAC ratio: 8.0x

A ratio above 3:1 usually means good performance, but there’s more to think over.

When the ratio is much higher, like 5:1 or 6:1, you might not be spending enough on acquisition, which could limit your growth.

These metrics share an interesting relationship – higher CAC usually leads to lower CLV, which affects your profits. This helps businesses:

- Assess marketing strategy results

- Make better resource allocation choices

- Find the right marketing budget

- Check if the business can last

CLV matters more than CAC because:

- Market conditions mostly control CAC

- Better CLV lets you spend more on acquisition

- Improving CLV often brings in more revenue

When you understand this relationship, you can make smarter decisions about customer acquisition investments.

Let’s say your monthly marketing and sales costs are $4,219,022.54 to get 3,000 new subscribers, which means your CAC is $1,406.62.

This number needs to match your expected customer lifetime value if you want to stay profitable.

The CLV:CAC relationship is a vital sign of how well your business runs and makes money.

Source: Product Plan

Keeping track of this ratio regularly and making it better will help you grow while maintaining customer acquisition best practices.

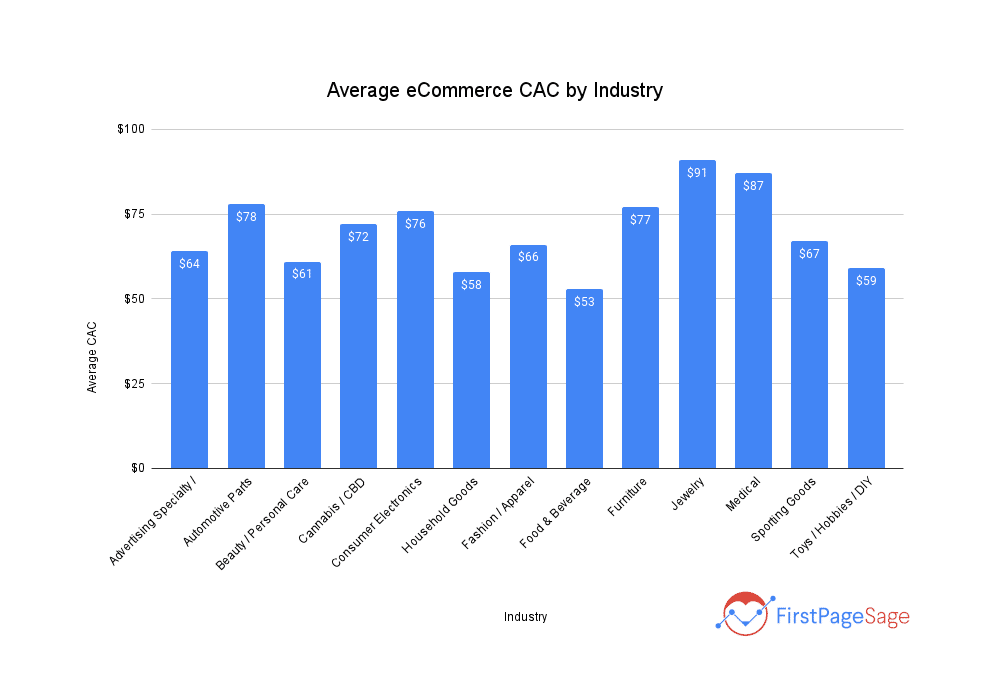

What is the industry average of CACs for e-commerce brands?

Source: First Page Sage

You can see that Jewellery has the highest CAC at $91, closely followed by Medical at $87. Automotive parts, Furniture, and Consumer Electronics’s CACs stand at $78, $77, and $76 respectively.

What are the key strategies to reduce customer acquisition costs?

Smart strategies can reduce your customer acquisition costs. Here’s a practical guide to optimise your CAC and keep your growth steady.

Optimise CRO

It’s simple really – Conversion Rate Optimization (CRO) cuts down acquisition costs because you can gain more customers from the same ad budget.

Your landing pages need A/B testing of different elements to find what appeals to your target audience.

You can experiment with a few options to understand what strikes the right chord with the user.

Companies can boost user experience and make conversions easier by looking at website data and making smart on-page changes.

You can also take measures to lower abandoned carts on your website by offering one-click or guest checkout options, adding exit pop-ups, and more.

Optimise paid ads and retargeting campaigns

Retargeting campaigns help you reconnect with potential customers who showed interest in your products.

Facebook ads with User Generated Content (UGC) show amazing results – they get 300% more clicks and cost 50% less per click.

You can reach your target audience across the funnel using retargeting on Google Ads display network or Facebook.

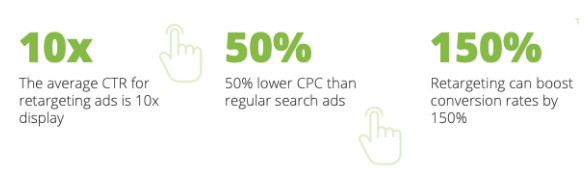

Source: Munro

If you’re wondering why go for retargeting, check out these numbers –

Retargeting ads get 10x more CTR, 50% lower CPC, and 150% higher conversion rates, making it one of the most effective strategies to lower your CAC.

Introduce referral programs

Referral programs are a big deal as it means that you pay only after successful conversions.

The numbers speak for themselves – referral customers cost 53% less than other channels.

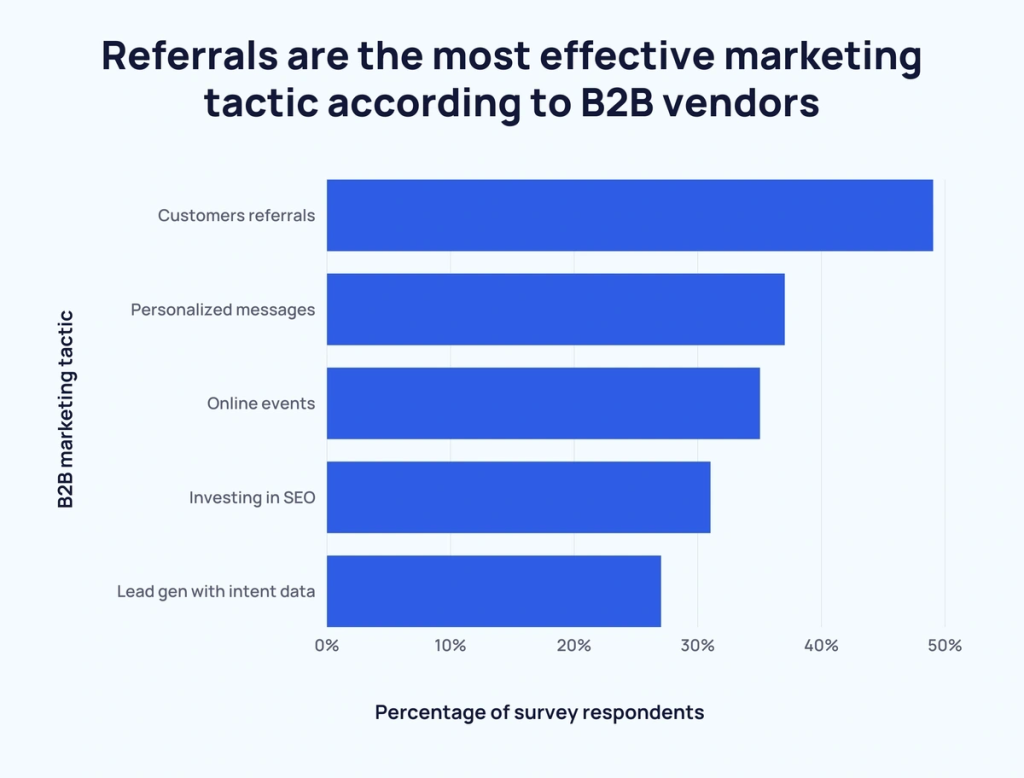

Source: Exploding topics

You can see that almost 50% of people would choose referrals over any other customer acquisition channels.

On top of that, these customers stick around longer with a 16% higher lifetime value.

Improve website performance

Your website speed affects your acquisition costs. About 53% of users leave websites that take more than three seconds to load.

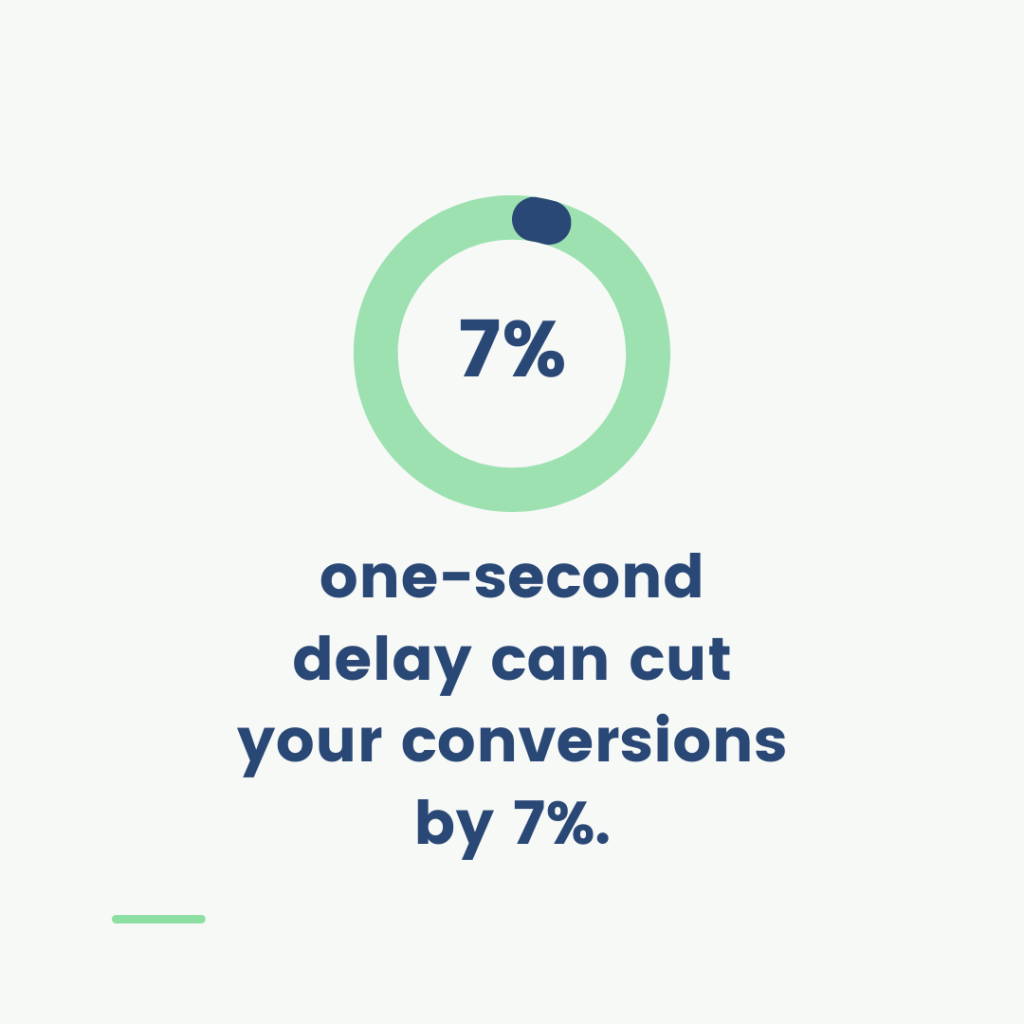

Source: Vidjet

Additionally, even a one-second delay drops conversions by 7%, making optimising your website performance vital.

Slow websites hit your ad costs too. Google’s Ad Rank algorithm looks at landing page speed, so slower pages mean higher Cost Per Click.

To avoid this, ensure that you have your website efficiently optimised to offer users a smooth user experience.

Also optimise your website for smartphones as most purchases are done through mobile phones in today’s world.

Social media and influencer marketing with UGC

UGC or User-generated content is the content that is created by end-users rather than the company. It helps cut acquisition costs.

Such content works best on social media as well as for PPC campaigns as customers tend to trust it more.

Customer reviews can help improve product conversions by 74%, making it the type of content that works best.

For this, you can go for micro-influencers who line up with your target audience. Their content often works better than bigger names because their followers are more engaged.

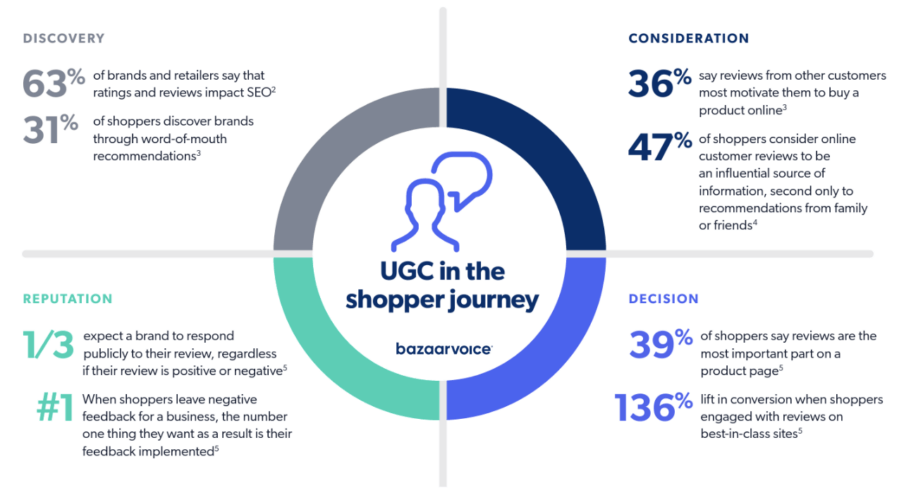

Source: Bazaar Voice

UGC content can help in every stage of the customer acquisition funnel.

- In the discovery stage, 63% of brands believe that it affects their SEO efforts, whereas 31% of users come across brands through referrals or recommendations.

- In the consideration stage, 36% of users are motivated to purchase a product because of other customer’s reviews, while 47% of them consider it to be an influential factor in their decision-making.

- One out of three users expect a brand to respond to a review online.

- When making a decision, 39% of shoppers think that reviews are the main part of a product page, whereas you can see a 136% boost in conversions when shoppers read positive reviews.

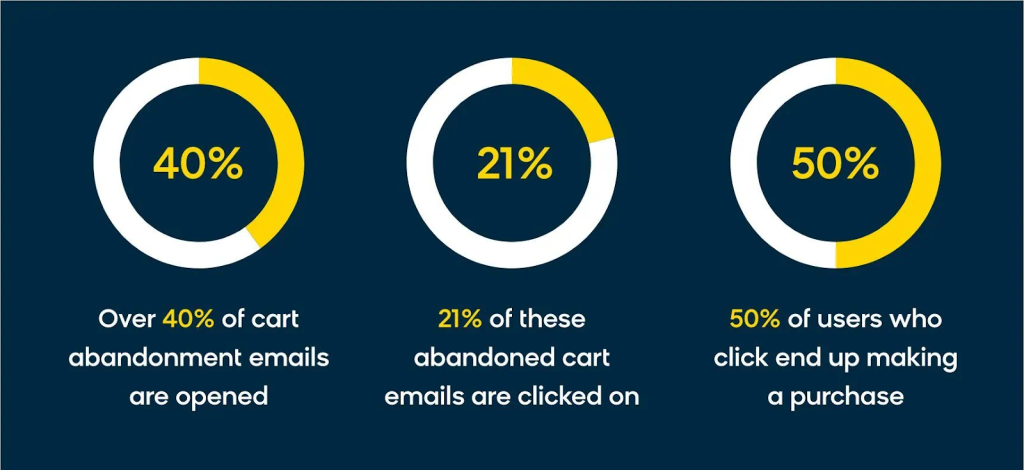

Bring back abandoned carts users

Your effort can amount to nothing if user does not go through with their purchase.

Cart abandonment hurts your bottom line – 69.82% of online shopping carts get left behind.

Abandoned cart recovery is a great way to reduce your CAC – you can win back these sales with personalised follow-up emails.

Source: Bloom Reach

Over 40% of abandoned cart emails are opened by the users, of which 21% click on the given link. 50% of these users end up making a purchase!

You can also win back these sales with personalised retargeting campaigns and exit-intent popups.

Clear shipping costs and multiple payment options help solve the most common reasons people abandon their carts.

These strategies can help you cut customer acquisition costs while keeping your growth strong. Evidence-based adjustments to your tactics will give you the best results.

Conclusion

Customer acquisition costs affect business success SIGNIFICANTLY, so optimising them is vital for your business’s growth.

Your business needs a strong foundation of profitable customer relationships, which comes from understanding and managing your CAC well.

The right balance between acquisition costs and customer lifetime value is significant: Your business performs best when the CLV stays three times above CAC.

This ratio will give adequate profit margins and support continuous growth.

Smart proven customer acquisition strategies can reduce acquisition costs. Conversion rate optimisation, targeted retargeting campaigns, and referral programs each bring distinct benefits.

On top of that, better website performance and user-generated content create ways to lower costs.

Note that CAC optimisation needs constant monitoring and fine-tuning. Regular analysis of metrics combined with analytical insights keeps your acquisition strategy affordable and efficient.

These strategies can transform your customer acquisition system when you implement them today, track their results, and adjust your approach accordingly.

Need more help with reducing your CAC? Get in touch with us today!